- Electronic administration allows most public procedures to be carried out online with legal guarantees, speed and greater convenience.

- Tools such as Cl@ve, digital certificate, DNIe and the Citizen Folder are key to identifying yourself and managing files.

- Self-employed individuals and SMEs must use online channels for registrations, taxes, social security contributions, subsidies and public procurement.

- Portals for changing your address, electronic registration and support services such as Acelera pyme facilitate the transition to digital management.

If you're fed up with wasting entire mornings in queues, at service windows and in-person appointmentsOnline administrative procedures have become your best ally. More and more dealings with the Public Administration can be done from the comfort of your couch, using your computer or mobile phone, without printing papers or waiting for the postman.

La digitization of public administrations and businesses It has advanced tremendously in recent years. Today you can manage taxes, social security, grants, electronic notifications, or register for competitive exams without ever setting foot in an office. However, to take full advantage of it, it's essential to understand which tools you need, what types of procedures are available, and how this whole "world" of e-government is structured.

What is an online administrative procedure and what guarantees do you have?

An administrative procedure is, basically, the set of formal steps you take before a public body To fulfill an obligation, claim a right, obtain assistance, or request a resolution to something that affects you. This could range from renewing your ID card or applying for a scholarship to obtaining... criminal record, register a company or file an appeal.

In Spain, the Public administration is governed by administrative law.That is, by a set of rules that dictate how it must act, what deadlines it has, what rights you have as a citizen or company and how the final decision is formalized (the famous administrative act that grants or denies what you have requested).

When you carry out a procedure, whether in person or digitally, you have a series of legal guarantees that prevent the Administration from acting arbitrarilyIf the decision goes against your interests, you can appeal it through administrative channels or, ultimately, before the contentious-administrative courts.

For citizens who are not required to interact electronically With government agencies, there are almost always two options: submitting documents in person (on paper) or electronically. Additionally, you can choose whether to receive notifications by mail or electronically.

However, in certain cases the law requires communication to be exclusively electronic. This affects, for example, companies, self-employed individuals, certain entities and professionals who, due to the type or volume of their activity, are required to use digital means. In these situations, it is no longer possible to submit documents on paper: everything must be done through electronic portals, electronic registries, and digital notifications.

Advantages of carrying out administrative procedures online

The expansion of e-government has represented a huge leap forward in convenience, speed and legal security This applies to both individuals and businesses. You no longer depend on office hours or whether the staff member who assists you is available.

A key advantage is that the Electronic offices are open 24 hours a day, 365 days a yearYou can submit an application on a Sunday night, pay a fee in the early hours of the morning, or download a certificate just when you need it, without waiting for the window to open.

Furthermore, electronic procedures are usually more agile and are resolved in shorter timeframesBecause all management is done through electronic files, with automatic records of every action. This increases internal control and leaves a record of all actions taken.

Online processing also offers greater legal certaintySince everything is recorded in the electronic file with the official date and time, registration number, copy of the documentation, and traceability of the electronic signature, this reduces errors and misunderstandings about whether something was submitted on time or not.

In terms of data protection, telematics systems incorporate security measures for the safekeeping of sensitive informationsuch as health, financial, or membership data. Properly configured, they are more secure than handling paper files circulating between desks and offices.

Another strong point is the accessibility for people with reduced mobility or who live far from the officesYou avoid travel, transportation costs, and unnecessary waiting, making it easier for anyone to fulfill their obligations without physical barriers, and there are also resources available. digital literacy for seniors that help reduce the technological gap.

We must not forget the environmental impact: by reducing the use of paper, printing and postal mailings, digital processing It contributes to lower resource and energy consumption.aligning with sustainability criteria.

Finally, e-government expands the channels of contact: you can combine online platforms, apps, telephone support and in-person registration (when permitted), always choosing the means that best suits you at each moment.

Digital identification tools: Cl@ve, digital certificate and electronic ID card (DNIe)

To complete administrative procedures online, you need to prove your identity, just as you would show your ID card at a counter. In the online environment, this is achieved through... electronic identification and signature systems recognized by the Administration.

One of the most used tools is the Cl @ ve systemThis is an identification platform that allows you to access services from different government agencies with a single user, without having to memorize dozens of different passwords for each organization.

With Cl@ve you can enter the Tax AgencySocial Security, DGT, ministerial headquarters, etc., and carry out one-off or recurring transactions with complete securityTo register, you need a Spanish National Identity Document (DNI) or Foreigner's Identity Number (NIE), a document that proves your identity (such as a passport), and a Spanish mobile phone number to which the authentication codes will be sent. Only one phone line can be associated per DNI.

The Cl@ve PIN variant is designed for sporadic effortsIt generates a temporary code each time you want to access it. This is convenient if you only do a few transactions per year and don't want to install certificates on your computer.

When you need a higher level of security or want to sign documents, the following comes into play: digital certificate issued by the FNMT (National Mint and Stamp Factory) or other recognized certification authorities. This certificate is a digital file containing your verified identification data and allows you to sign electronically with legal validity.

A digital certificate is essential for Many advanced procedures: filing certain tax forms, mass processing, signing documents, accessing internal company systems, or mandatory relationship of self-employed individuals with the AdministrationYou can obtain it through in-person verification or via video call, depending on the issuing entity.

Another option is the Electronic DNI (DNIe)It incorporates a chip with advanced authentication and signature certificates. To use it on a computer, you need a card reader and the corresponding software, but it offers a very high level of security for signing documents or accessing online portals.

Along with these credentials, the following are also used advanced and qualified electronic signatures integrated into corporate platforms, very common in companies that manage large volumes of documentation with several administrations or in public procurement processes.

Main online administrative procedures for citizens

The list of things you can do online is very long, but there are a number of essential services that are useful to keep under control for everyday life as an individual.

One of the most common is appointment request to visit offices where physical presence is still required: renewal of ID card or passport, immigration procedures, appointments at the SEPESocial Security, Tax Agency, regional health services, Civil Registry, DGT, etc.

Booking an appointment online allows better organize your time and avoid unnecessary waiting in officesThrough the enabled portals you can choose a date, time slot and, in many cases, modify or cancel the appointment if something unexpected comes up.

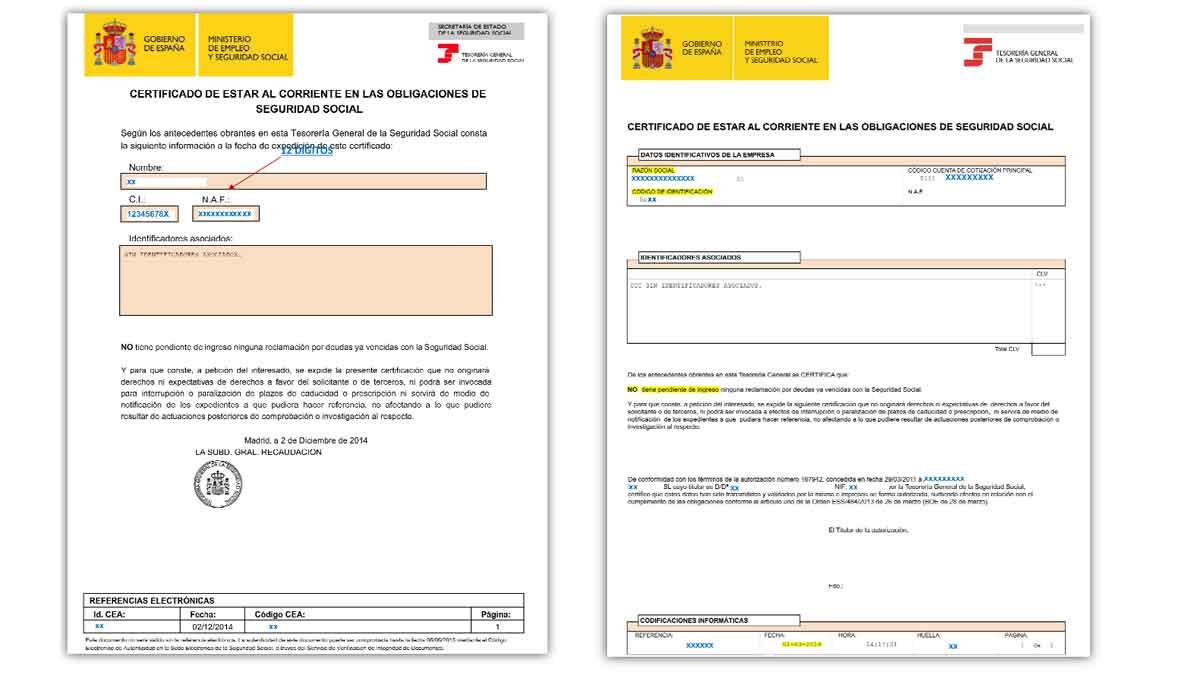

Another important block are the Social Security certificates and reportsThrough its Electronic Office and the Import@ss portal, you can download your employment history, contribution base reports, quotation certificates, certificates of being up to date with payments, duplicates of affiliation documents or managing registrations and cancellations of certain schemes.

It is also possible from that same platform modify personal data, process benefit applications, provide medical reports, or carry out numerous procedures both as a citizen and, where applicable, as a representative of companies or family members when regulations permit. Furthermore, many processes include specific procedures, such as the management of sick leave for self-employed workers in your case

The electronic notifications They are another pillar of online administration. Through the Authorized Electronic Address (DEH), you can receive official communications without relying on a physical mailbox. Once you register with your National Identity Document (DNI) or digital certificate, you obtain a unique electronic address associated with your Tax Identification Number (NIF).

In that mailbox you can Check notices from the Tax Office, Social Security, DGT and other agencies Subscribe to the service. It's a secure, free, and very useful system for not missing deadlines for appeals, claims, or document submissions, as long as you check your inbox regularly.

Another very practical tool for citizens is the Citizen FolderThis is a personal online space where you can view the status of your files, received notifications, submitted records, and the data that the Administration has about you in different systems, such as the certificate of professional status.

Key digital procedures for the self-employed and businesses

In the case of the self-employed and SMEs, the relationship with the Administration is even more intense. Since 2018, self-employed workers have been required to carry out its main operations electronically, including requests such as the benefit for cessation of activity, using digital certificate, DNIe or permanent Cl@ve.

The first step to starting an activity is tax registrationThis is done by submitting forms 036 or 037 through the Tax Agency's Electronic Office. In this process, you define your economic activity, VAT regime, tax obligations, and tax domicile.

At the same time, it is necessary to manage the High social security in the Special Regime for Self-Employed Workers (RETA). This is done online through Import@ss or the RED system, indicating contribution bases, coverage and start date of the activity.

Once discharged, much of the recurring work consists of electronic filing of taxesUsing a digital certificate or Cl@ve, you can file quarterly and annual returns for personal income tax, VAT or other taxes, pay debts, set up direct debits or request deferrals and installments.

The Tax Office allows, for example, request a deferral of tax payments when you find it difficult to pay them all at once. The procedure is done entirely online: you indicate the debt, propose a payment schedule, and attach supporting documentation, if applicable.

It is also common for companies to have to pay local or regional taxes and fees electronicallyFrom business tax (IAE) and property tax (IBI) to fees for licenses, outdoor seating areas, waste disposal, and certain municipal and regional services, each city council or regional government offers its own payment and inquiry platforms.

Another recurring document is the census status certificateThis document certifies your registration in the census of business owners, professionals, and withholding agents, as well as your basic tax information. It can be requested and downloaded online and is typically used for public tenders, bids, banking procedures, or with other organizations.

When the time comes to cease activity, the Deregistering as self-employed with both the Tax Office and Social Security It is also processed electronically. The corresponding forms are submitted, the census status is updated, and the termination of contributions to the RETA (Special Regime for Self-Employed Workers) is communicated.

For commercial companies, in addition to all of the above, procedures such as the following come into play: Registration in the Commercial Registry, application for a definitive NIF (Tax Identification Number), registration of the company in Social Security and management of employee registrations and terminationsMany of these operations are channeled through the CIRCE platform and the Single Electronic Document (DUE), which simplifies the registration and deregistration of companies.

Companies' daily dealings with Social Security are carried out through the RED systemwhich allows you to process quotes, affiliations, employee registration and deregistration forms, data modifications or report consultations without having to go to a physical office.

Subsidies, public aid and electronic contracting

Another essential part of online administrative procedures for SMEs and the self-employed is everything related to public subsidies, aid and incentivesat the state, regional and local levels.

To identify funding opportunities, you can consult the National Subsidy Database (BDNS)where official calls for aid are published. Likewise, platforms like Acelera pyme include specific programs for digitalization, innovation, and support for business transformation, as well as measures such as... Youth Warranty managed by the SEPE.

The process is usually done entirely electronically: the application is submitted, the required documentation (budgets, reports, certificates) is attached, and It tracks the case file through electronic offices. of the convening Administration, whether state, regional or local.

Once the aid has been granted, the justification phase begins, where digital channels are also used to send invoices, proof of payment, Bank statements and any documentation that proves that the conditions of the grant have been met.

In the field of public procurement, the Public Sector Procurement Platform (commonly called the State Procurement Platform) centralizes the publication of tenders, specifications, announcements, and awards from numerous agencies. Through it, companies can find opportunities and submit electronic bids when the procedure allows.

This digitization of procurement facilitates access for SMEs to public tenders, offering greater transparency, equal opportunities and reduced bureaucratic burdensprovided that the company becomes familiar with the use of digital certificates and bidding platforms.

Notification of change of address and electronic registration

One of the paper-based procedures that caused the most headaches was the address changeThis was because it required separate notifications to the Tax Office, Social Security, the Traffic Department, and other government agencies. Nowadays, the Change of Address Notification Portal greatly simplifies this process.

Through this service, once you have registered in the new municipality, you can officially notify different organizations of your new address at the same timewithout having to travel to each one. This saves time and reduces the risk of any administration continuing to send notifications to an outdated address.

Regarding the registration of documents, the Administration has the General Electronic Registry and the Registry Portal for Public Administrationswhere documentation addressed to different units and organizations can be submitted with full legal validity.

An interesting example of public-private integration is the ORVE service (Electronic Virtual Registry Office), through which entities such as Correos can Digitize physical documents and send them electronically to the Administrationacting as an intermediary.

To use these types of services, the documents must meet certain requirements: A4 format, without complex bindings, in good condition and without non-digitizable supports such as rigid cardboard or especially delicate papers. Electronic documents are not accepted for digitization in the offices, nor are bindings handled in a way that could damage the original.

Once scanned, the documentation is reviewed to check its legibility and correspondence with the originals, it is registered electronically on the Administration portal, the data of the company and the destination body are completed (including the DIR3 code of the processing unit) and sign the submission electronically, generating an official safeguard for the interested party.

Administrative digitization: context and support for SMEs

The digitization of administrative procedures is not a passing fad, but a structural transformation of the relationship between citizens, businesses and the AdministrationIn Spain, more than 90% of procedures are now carried out electronically, reflecting the extent to which this model has become widespread.

This evolution directly impacts the daily management of tax, labor, and legal obligations: filing taxes, paying social security contributions, processing employee registrations and terminations, applying for subsidies, and participating in tenders are increasingly done through electronic offices, specific portals and digital identification platforms.

For many SMEs and self-employed individuals, however, the change is not easy. There is a clear barrier of knowledge and familiarity with digital toolsas well as a certain fear of making mistakes in an environment they perceive as complex or unintuitive.

To overcome this obstacle, there are initiatives such as the Acelera Pyme offices, the PAE Network (Entrepreneur Support Points) or business support platforms that offer free advice, training and support in the adoption of digital tools for procedures with the Administration.

Likewise, numerous regional or provincial bodies are launching Specific training sessions on digital certificates, online tax management, use of online Social Security, and access to public procurementhelping the business sector adapt step by step.

This entire ecosystem is complemented by online courses, specialized blogs, and official guides that explain in a practical way how to carry out specific procedures, what mistakes to avoid and what solutions to adopt to get the most out of electronic administration.

However, the current scenario offers a clear opportunity: those who take the time to learn how to manage digital certificates, electronic offices, and help platforms They manage to reduce administrative costs, minimize errors, and gain a lot of agility. in its relationship with the public, something especially valuable in a competitive and changing environment.

Online administrative procedures allow citizens, the self-employed, and SMEs to manage their obligations and rights with a mix of efficiency, traceability and simplicity unthinkable just a few years ago, provided they rely on the appropriate identification tools, take advantage of electronic headquarters and registries, and use available advisory resources when needed.